Sonoma County Real Estate:A 2025 Year-End Market Recap

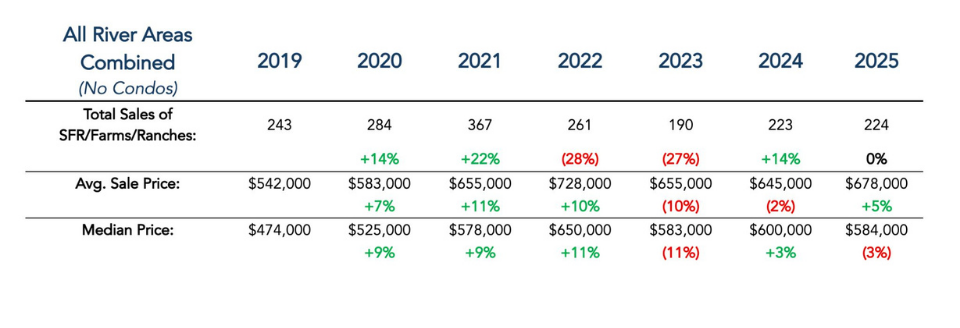

The Sonoma County real estate market in 2025 can best be described as a year of stabilization. After the dramatic highs of 2021 and the market stalling that followed, this past year marked a return to a more measured and sustainable pace—one where buyers and sellers alike adjusted expectations and made decisions with greater clarity.

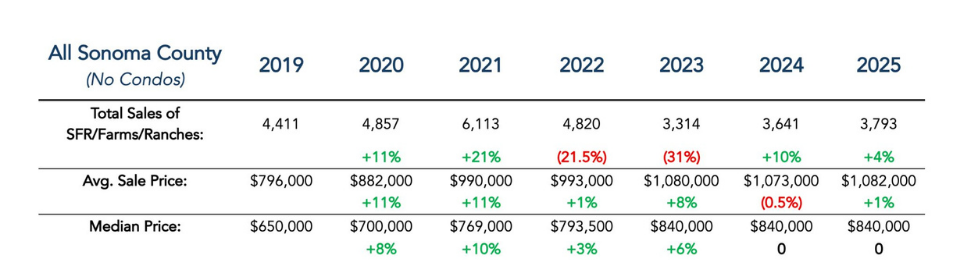

Across Sonoma County, total single-family home sales increased to approximately 3,793 transactions, up from 3,641 in 2024, signaling a modest but meaningful rebound in activity after two slower years . While this volume remains well below the peak of over 6,100 sales seen in 2021, it reflects renewed confidence and a market that is no longer retreating.

Pricing told a similarly grounded story. The average sale price countywide rose to about $1,082,000, a roughly 1% increase year over year, while the median price held steady at approximately $840,000 . Rather than signaling weakness, this combination of stable prices and increased sales points to balance. Buyers were active, but no longer willing to overextend, and sellers who priced realistically were still rewarded with successful outcomes.

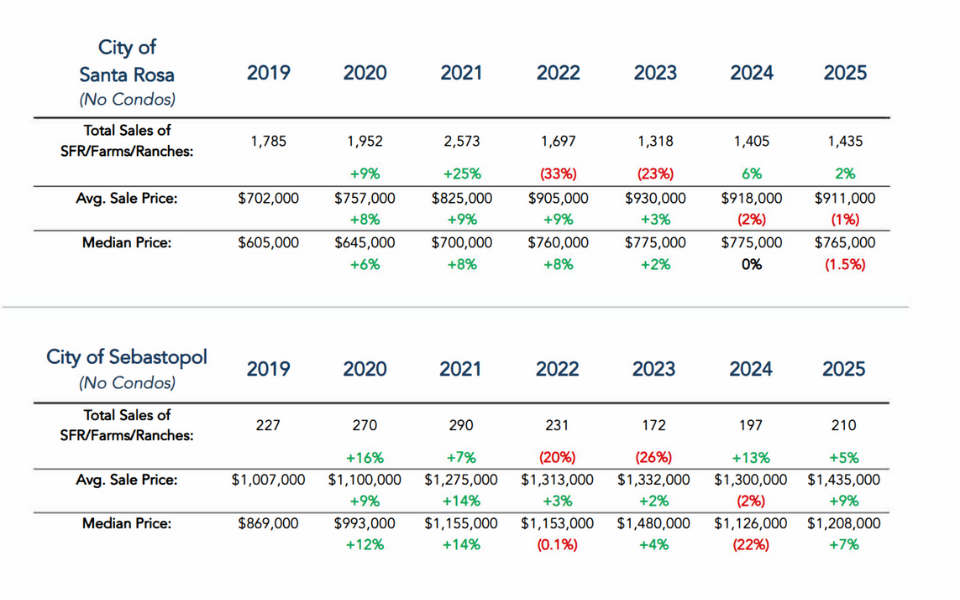

In Santa Rosa, the county’s largest and most influential market, sales rose slightly from 1,405 homes in 2024 to 1,435 in 2025. At the same time, the median price dipped modestly from $775,000 to $765,000, while the average price softened from $918,000 to $911,000. This combination gave buyers more breathing room without undermining long-term equity for homeowners, reinforcing Santa Rosa’s role as a stabilizing force within the region.

Make it stand out

Other cities showed varied but telling trends. Sebastopol stood out as one of the stronger performers, with total sales increasing to 210 homes and the average sale price jumping to approximately $1,435,000, a notable increase over 2024. The median price also rose to about $1,208,000, reflecting continued demand for its unique mix of charm, land, and lifestyle

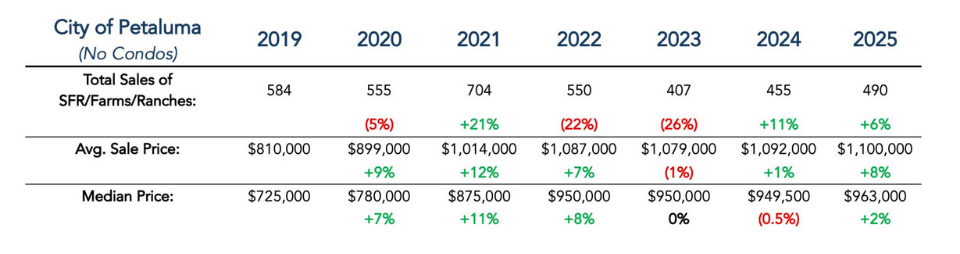

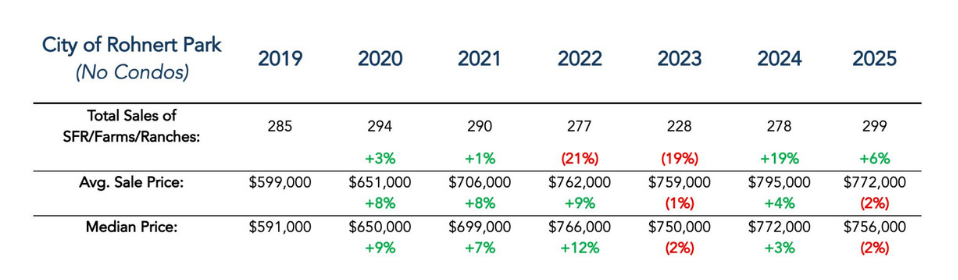

In Petaluma, sales climbed from 455 to 490 homes, while the median price edged up to roughly $963,000, indicating renewed activity without the intensity of previous boom years. Windsor and Rohnert Park experienced similar patterns—slightly higher sales volumes paired with mostly flat pricing—further evidence of a market settling into equilibrium.

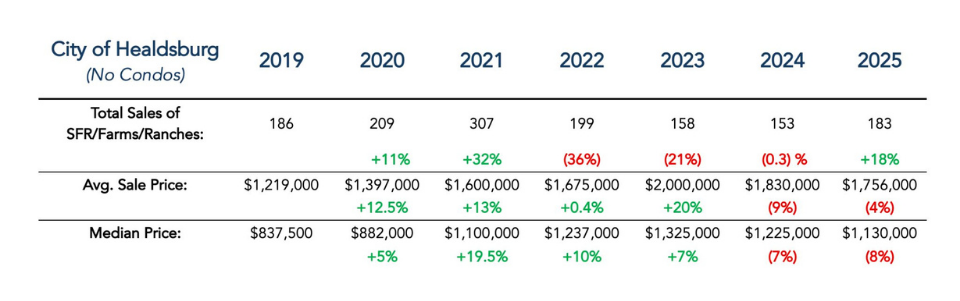

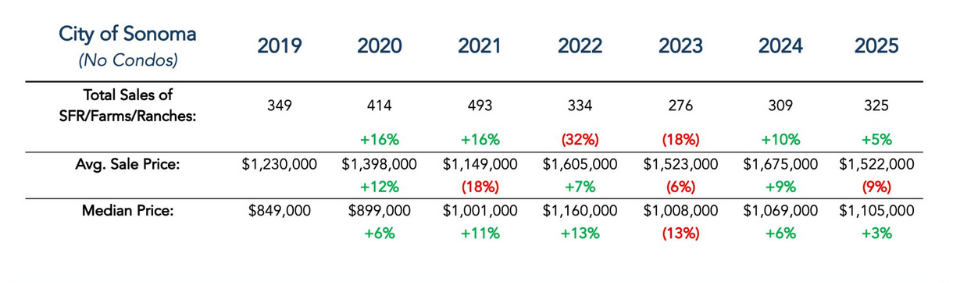

Luxury markets such as Healdsburg and Sonoma remained more selective. Sales volume stayed relatively low, but pricing held firm, with Healdsburg’s average sale price landing near $1.75 million and Sonoma’s around $1.52 million. These areas continued to reward well-positioned properties while leaving less compelling listings on the market longer.

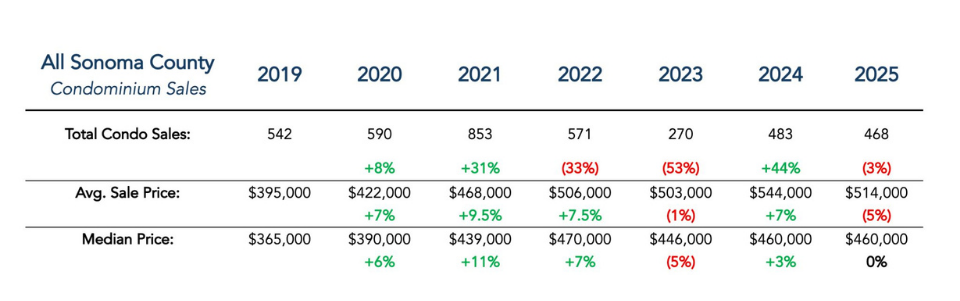

The condominium segment, by contrast, remained softer. Countywide condo sales totaled about 460 units, down slightly from the prior year, with the median price holding at roughly $460,000. This segment continues to lag single-family homes as buyers remain selective and interest-rate sensitive.

Taken as a whole, 2025 was not a year of dramatic appreciation or rapid acceleration. Instead, it was a year in which the market found its footing. Buyers regained negotiating power, sellers recalibrated expectations, and transactions increasingly reflected thoughtful decision-making rather than urgency.

From a long-term perspective, homeowners remain in a strong position. Even with recent adjustments, prices across Sonoma County are still significantly higher than pre-pandemic levels, and the region’s desirability continues to support value over time.

As we look ahead, the 2025 market provides a healthier foundation than the volatility that preceded it. It favors preparation, strategy, and local insight—and for those considering a move in the coming year, that is a far more reassuring environment than one driven by extremes.

If you’d like to explore how these countywide trends translate to your specific neighborhood or goals, I’m always happy to walk through the numbers with you and talk through next steps.